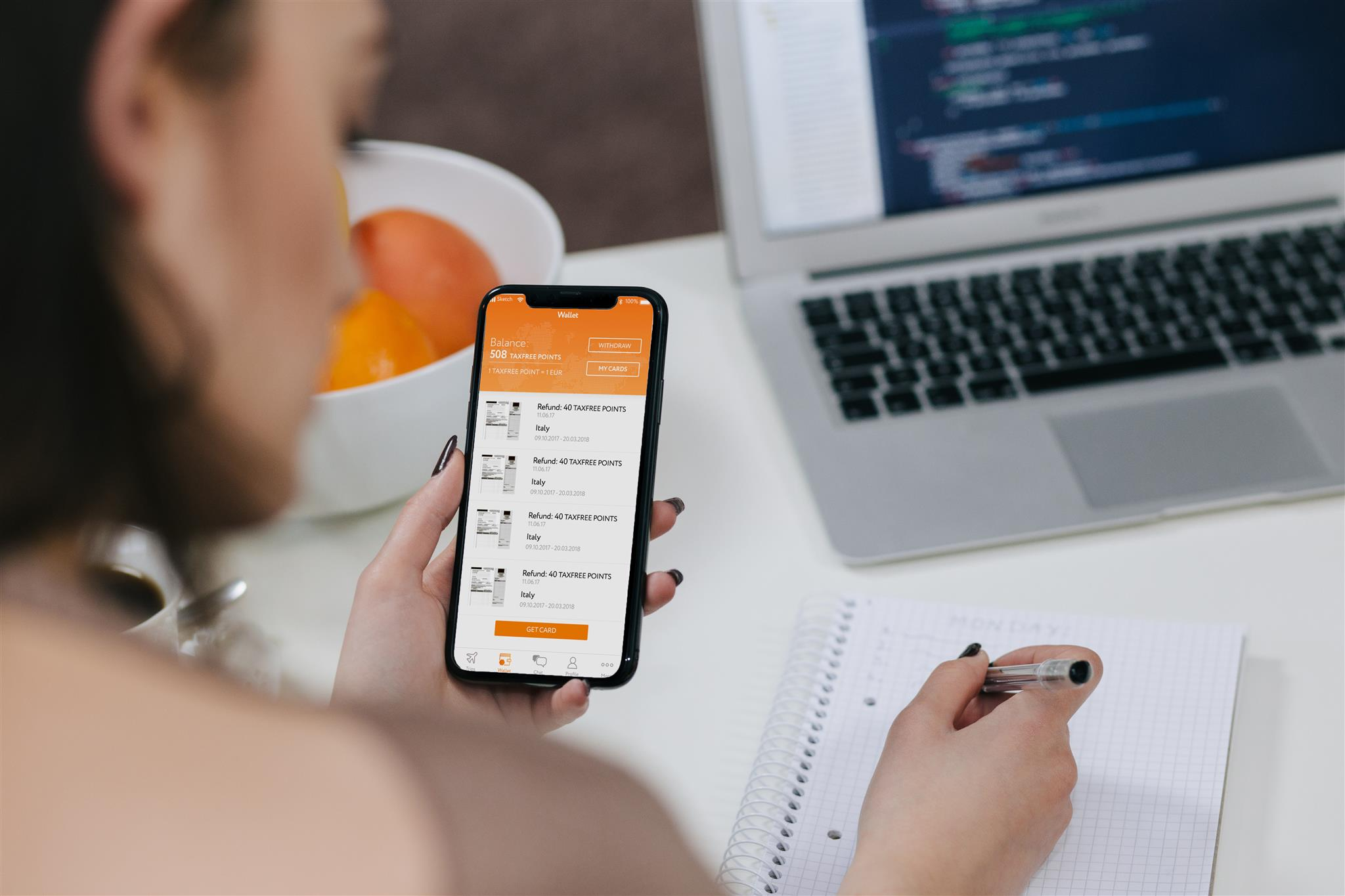

The TaxFree4U application is a convenient and easy way to get VAT refunds from purchases in 2 European countries: Italy and France. In order to get a refund, you need to be attentive to several important points:

1.Your profile must be filled in completely and it should contain:

– valid e-mail address;

– your contact telephone number;

– photo of the first page of your valid international passport;

– home address;

The TaxFree4U Support Team will fill all other fields.

2.Don’t forget to take photos of your receipts/invoices and upload into the app, and you should pay attention to the time of when you are filling in your application for a refund. Receipts/invoices from purchases must be uploaded on the day of purchase; otherwise, you will not be able to receive a refund.

Legislation of the European countries has a clear description of receipts/invoices for VAT refund. Receipts/invoices are issued by the cash register in the sales network. The Receipts/invoices must not be damaged; should in good quality and should involve all positions.

Receipts/invoices must be readable. Receipts/invoices date must match the dates of your trip. On the Receipts/invoices should be no marks from other tax free refund operators. The Receipts/invoices should contain:

-name of shop;

-individual Receipts/invoices number;

-address and contacts of the store;

-Product Name;

– amount of the discount and the total amount, including VAT;

-individual tax number of the store;

– taxation of VAT;

-the sum of VAT.

3. In order to receive a VAT refund, you must prepare a package of original documents that you need to transfer to TaxFree4U:

- the original tax free form (export declaration) with the invoice and stamp of the customer’s officier;

- originals of receipts/invoices for your purchases.

After passing the customs control, you should bring original receipts/invoices and a validated declaration take home. After that, please contact the client support department of TaxFree4U to order a courier at the company’s expense:

Viber, WhatsApp: +447438703469

E-mail: support@taxfree4u.eu

You will need to transfer the issued declarations and original checks from the stores to courier.

4.You can find out about the status of your applications by accessing TaxFree4U support service:

E-mail: support@taxfree4u.eu

Viber: +447438703469

Phone:

FR: +33 980 091018

UA: +38 044 2235384

Contact us by Viber or WhatsApp and we will call you back

5.You can download the application by clicking on the links:

GooglePlay – https://play.google.com/store/apps/details?id=eu.taxfree4u.client&hl=en

AppStore – https://itunes.apple.com/ua/app/taxfree4you/id1081482540

6.In what terms does the payment take place?

The payout time report must be started ONLY after the TaxFree4U service receives the original reciepts and a blank declaration. When the TaxFree4U Support Team receives the original of all the documents, the deadline is set from 30 to 90 days, during this time the company’s employees provide confirmation of the fact of the carried out purchases.

7.Why a receipt/invoice can be rejected?

Often receipts/invoices that are uploaded to application don’t meet the requirements. One of the most frequent mistakes of our customers is the failure to meet the deadlines for uploading receipts/invoices: in Italy, for example, a mandatory requirement is to upload receipts/invoices on the DAY OF PURCHASE (otherwise, those receipts/invoices will be rejected).

Receipts/invoices that can not be accepted for work:

– Receipts/invoices that do not meet the above requirements;

– Receipts/invoices for paid services (hotel accommodation, car rental, restaurant bills, etc.);

Receipts/invoices that is non-refundable:

France – Tobacco, medicines, vehicles and spare parts, weapons, antiques and works of art France over 50 years old, postage stamps

Italy – Fuel, vehicles, books