Make purchases in any store which provides receipts with VAT

Be alert, if in a store you were given the form of another TaxFree operator

HOW TO RECIEVE THE VAT REFUND

for non-EU resident

1

Purchase

2

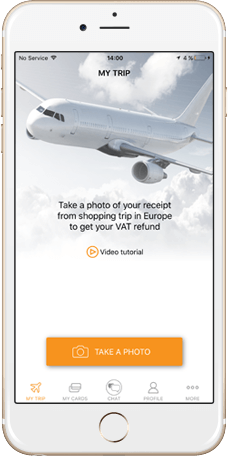

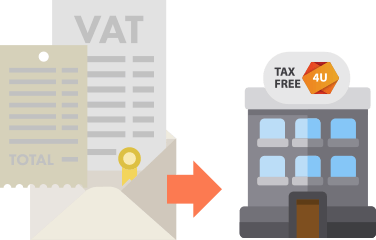

Upload invoices

Take a photo of the invoices and upload it to the mobile application on the day of purchase, but no later than 24 hours before departure.

3

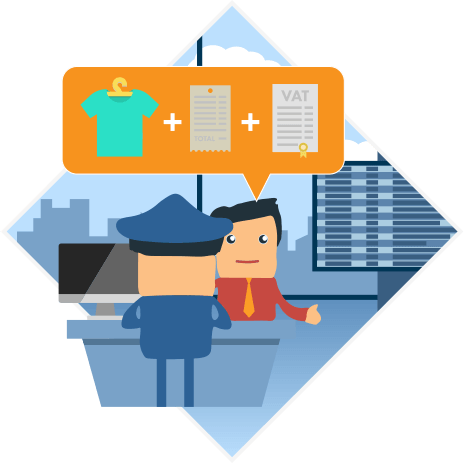

Get a stamp

Produce the VAT form at Customs and receive a stamp from the customs officer

5

Get your refund

Get your VAT refund on your card

EUROPEAN COUNTRIES IN WHICH WE OPERATE

You can make purchases of these 4 countries, but the country of your departure can be any of EU country.

France

Italy

ADVANTAGES OF REFUND WITH TAXFREE4U

- High rates

– up to 19% of the VAT refund

- Fast refund

– on the bank card of the client

- Consolidation of receipts

– up to 30 receipts into 1 VAT refund form to overcome the minimum purchase amount

- Filling-in of the VAT refund form

– TaxFree4U fills in the VAT refund form for the client

- TaxFree4U shops

– make purchases in any store which provides receipts with VAT

- Mobile app

– you only need your smartphone to get the VAT refund