Your purchases should be individual (for personal / family use only)

The minimum amount for the purchases to complete a single VAT form:

- France – 1500 EUR

- Italy – 1500 EUR

You should export goods to your country of residence by yourself

You should export goods to your country of residence by yourself

You should upload the colored copy or a colored scan copy of the 1st page of the passport in the two-pages spread via the mobile app or when signing up at the website. In exceptional circumstances, the passport photo can be sent via e-mail to the TaxFree4U Customer support manager ([email protected]).To create a copy of the passport you can use the camera of your mobile phone. Open the 1st page of your passport take a picture of it in the two-pages spread. Check the received image. It should not contain any indistinct areas and text should be readable.

The passport photo should be horizontal oriented and made not more than 3 months prior to the registration in the TaxFree4U system.

When attaching the document you should consider that, a low-quality copy of the passport will prevent you from completing the registration in the TaxFree4U system and from start using our service! Your registration request will be sent for revision until you upload a good-quality image.

The invoice/receipt is given by the cash register at the retail store. The invoice/receipt should be in one piece, of good quality, all items on the invoice/receipt should be readable without information about Client/buyer. The date of the invoice/receipt must correspond to the date of your trip. There should be no other marks of any other tax free refund operators. The invoice/receipt should contain:

You should upload invoices/receipts at the business time on the day of purchase! One receipt – one photo.

Each country has its individual regulations of the VAT refund from the purchases made. The major conditions for France and Italy:

When you leave the country of the European Union, present your purchases, passport and package of documents from TaxFree4U to a customs officer to get confirmation of your declaration (getting a stamp customs officer). Make sure that the customs officer stamped (stamped) on your documents - Tax Free form (export declaration) with invoice. Please note that:

at airports in France in the case of special PABLO terminals, you validate (confirm export) the form provided by Tax Free in PABLO terminals by scanning the bar code on the form;

at Italian airports, you validate (confirm export) the form provided by Tax Free in the OTELLO system with the help of a customs officer - the customs officer enters the data into the OTELLO system. You can check the status of validation by link;

Please arrive in advance of departure to complete the confirmation process from the customs service.

If your trip continues in the other country of the European Union, you will have to submit the VAT form (export declaration) to the export customs officer in the final departing point from the European Union.Note: no customs stamp = no VAT refund

Getting export validation (stamp from the customs officer on the VAT form) – is one of the major rules of getting the VAT refund. Execution of this right confirms that purchased goods were exported from the country of purchase into your home country.Note: no customs stamp = no VAT refund

TaxFree4U keeps the processing fee for each tax free form. The refund amount equals the total amount of the VAT paid, less the processing fee of the tax free form. The amount of the refund depends on the country and the amount of the acquisitions. The amount of compensation you can calculate using the calculator on our website https://taxfree4u.eu/en/calculator/

You can get the VAT refund amount on any other card. To get a refund on the bank card, specify its number in the mobile app or in the user area at www.taxfree4u.eu.

The package of the original documents that you need to submit to the TaxFree4U consists of:

After passing the customs control, you should bring original invoices/receipts and a voided declaration take home. After that, please contact the client support department of TaxFree4U to order a courier at the company’s expense:

Viber, WhatsApp: +447438703469

E-mail: [email protected]

You will need to transfer the issued declarations and original checks from the stores to courier

Send the documents upon your arrival to the country of residence. Documents are delivered at the expense of TaxFree4U.

More convenient for you to use the services of mail, send documents through any branch of “Nova Poshta” to our name: TaxFree4U, Kyiv, № 58.

It is necessary to specify phone number recipient +38 063 48 57 530.

After arrival to your home country, please, contact customer support team for the organization of courier delivery of documents to our office. Documents are delivered at the expense of TaxFree4U.

If you have any questions, please call / write to customs support service.

The VAT refund is made after TaxFree4U received the originals of your documents within the following period:

For any further information, please, address the following contacts:

E-mail: [email protected]

Viber: +447438703469

Phone:

FR: +33980091018

UA: +38 044 2235384

TaxFree4U supports the following systems – MasterCard, Visa.When transferring refund on credit cards MasterCard and Visa, the refund will be enrolled in the currency of your credit card or in the currency of the country in which it was issued.In the case of the refund in the currency that differs from the currency of the completed VAT form, the selling rate of the reputable European bank for retail banking applies plus FX commission.

Export validation is the process of getting a stamp on your document package (VAT form and invoice) at the customs office in the check-in area/airside zone of the airport, or from an authorized company, or in the E-terminal. Export validation is made in the final check-point at the departure airport from the European Union.For example, if the traveler flies en to route London – Milano – Riyadh, the validation procedure (check-out and getting stamps on the VAT form) should be taken by the customer in Milano at the Customs Office.

Standard rate: 20 %

Medical supplies: 10 %

Food, books: 5,5 %

Reduced tax rate for some products and services: 2,1%

1500 EUR (all invoices/receipts that correspond the requirements are summed)

VAT refund is paid for goods exported in the personal luggage of the traveler. Exported purchases should be in the original packages and unused.

The maximum amount of exported goods of one type is 50 items.

Goods not admissible for getting the VAT refund:

Tax free Territories:

Overseas departments: Guadeloupe, Guiana, Martinique and Reunion (special VAT is applicable on Corsica)

If the PABLO kiosk / Customs office is located before the check-in and passport control zone:

NOTICE! (Extract from the instruction of the French customs):

NOTICE! (Extract from the instruction of the French customs):

Randomly customs officials can check your rights to have a refund of VAT. You must provide some documents that proof your permanent residence is outside the European Union, your valid ticket and goods subject to reimbursement. If you refuse to provide any document from the list - it may lead to the cancellation of the form of Tax Free and a fine.

The customs officer is entitled to request to show him goods at his own discretion.

If the PABLO kiosk / Customs office is located after the check-in and passport control zone:

Please make an attention: from November 01. 2017 our service suspended the work with few shops in France: Louis Vuitton, Chanel, Hermes.

Standard rate: 22%

Food: 10%

Milk, fruits and vegetables: 4%

1500 EUR (all invoices/receipts that correspond the requirements are summed)

The VAT refund is paid for the goods that are exported in the personal luggage of the traveler. Exported purchases are required to be in the original package and unused.

Livigno, Campione d’Italia, territorial waters of Lugano Lake

If the Customs Post placed before registration and passport control:

If the Customs Post placed after registration and passport control:

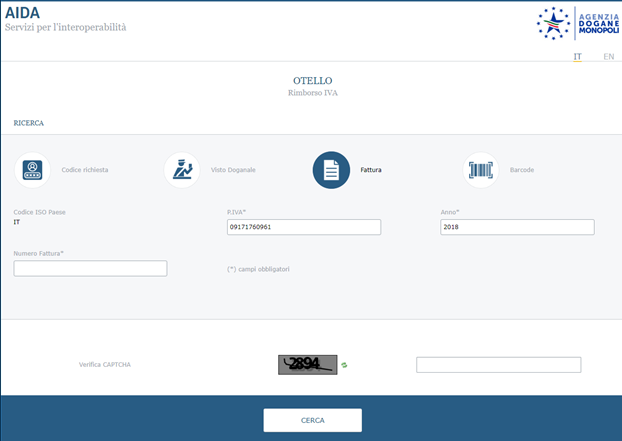

To check your declarations status, follow the link https://www.adm.gov.it/portale/web/aida-servizi/otello choose the box “Fattura” and fill in the appropriate fields with data for verification.

You can change website interface language to English.

Verification form should be filled in with the following data:

Fill in the verification box CAPTCHA and press the button CERCA.

If there is no Customs officer at the Customs VAT Office please contact the attendant officer via the phone located near the office, and inform about your presence.

Dear Clients!

NOTE!

Dear Clients,

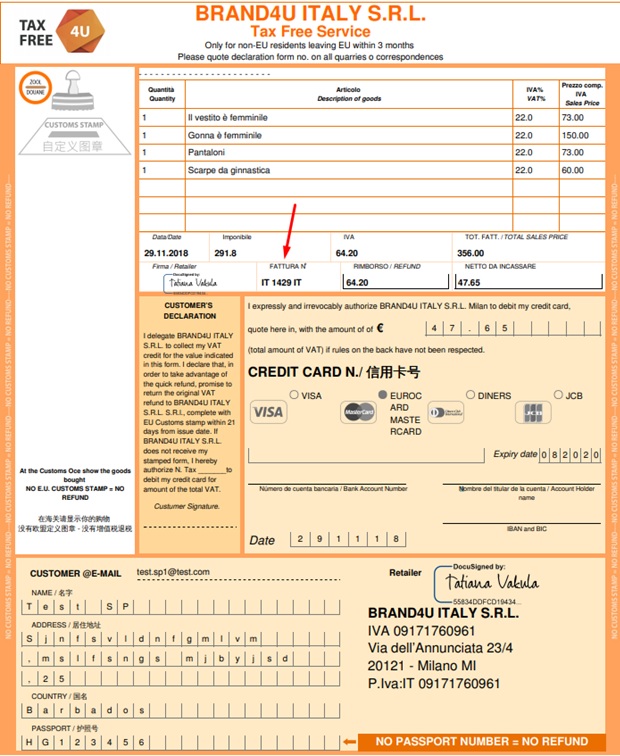

A prerequisite for processing a refund from purchases in stores in Italy is the presence of a correctly issued INVOICE (account). Checks confirming purchases are not accepted.

Before making a payment for the purchase, do not forget to inform the seller about the need to invoice the following details of the Company:

BRAND4U ITALY S.R.L.

Via dell’Annunciata 23/4 - 20121 Milan (MI)

Il numero dell’azienda: MI-2073708

Partita IVA: 09171760961

PEC email: [email protected]